Document collection, simplified.

Examples of what we are looking for.

-

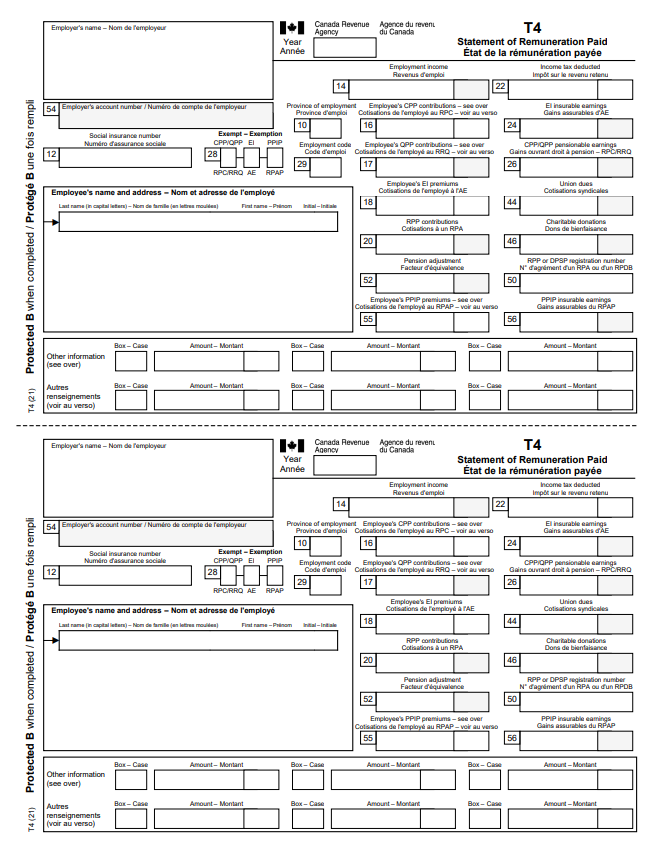

T4

Your T4 is issued by your employer each year in February. It is an official document that confirms your gross employment income and taxes paid. If you don’t have a copy of this, you can reach out to your employer for it as they must keep them on file. You might also find it in your CRA account.

-

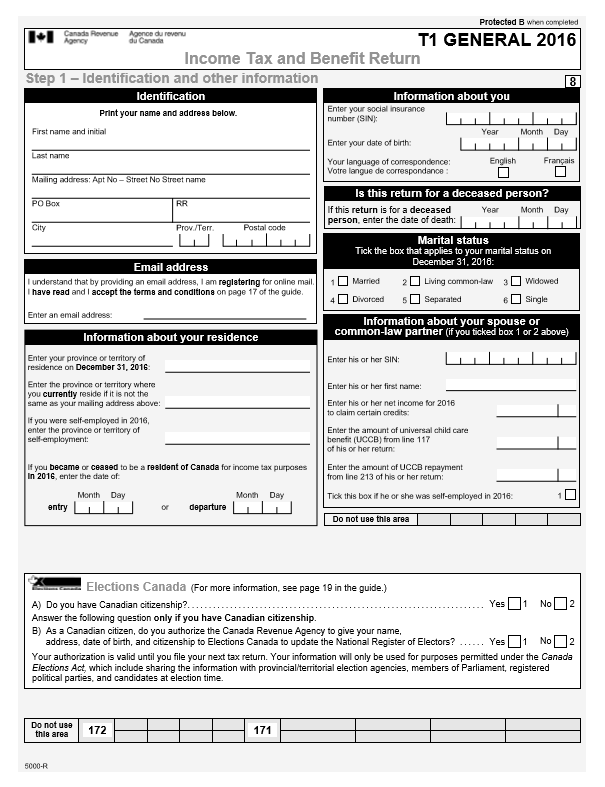

T1

The T1 General is the official document that you or your accountant prepares and submits to the CRA at tax time. This document contains your gross income, net earnings, business expenses and other pertinent information pertaining to your overall income.

-

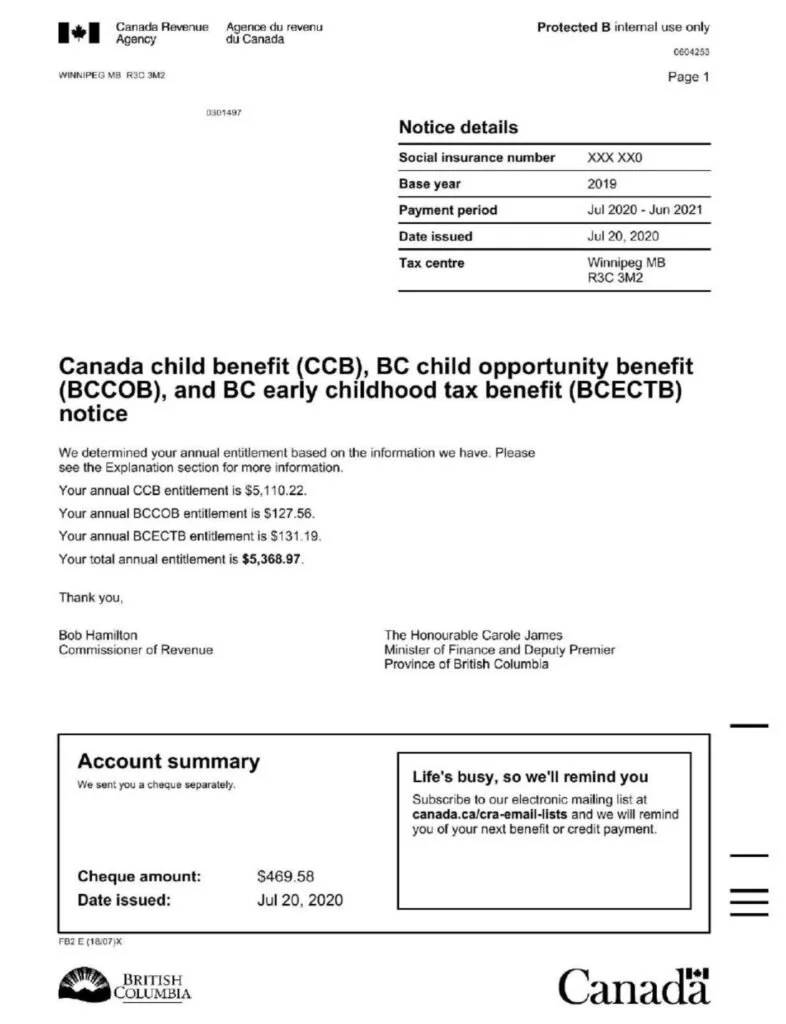

CCB Statement (Child Tax Benefit)

This statement is issued by the CRA every July to confirm your next years tax credit amount. This will be mailed to you or you can find it online in your CRA account under “mail”.

-

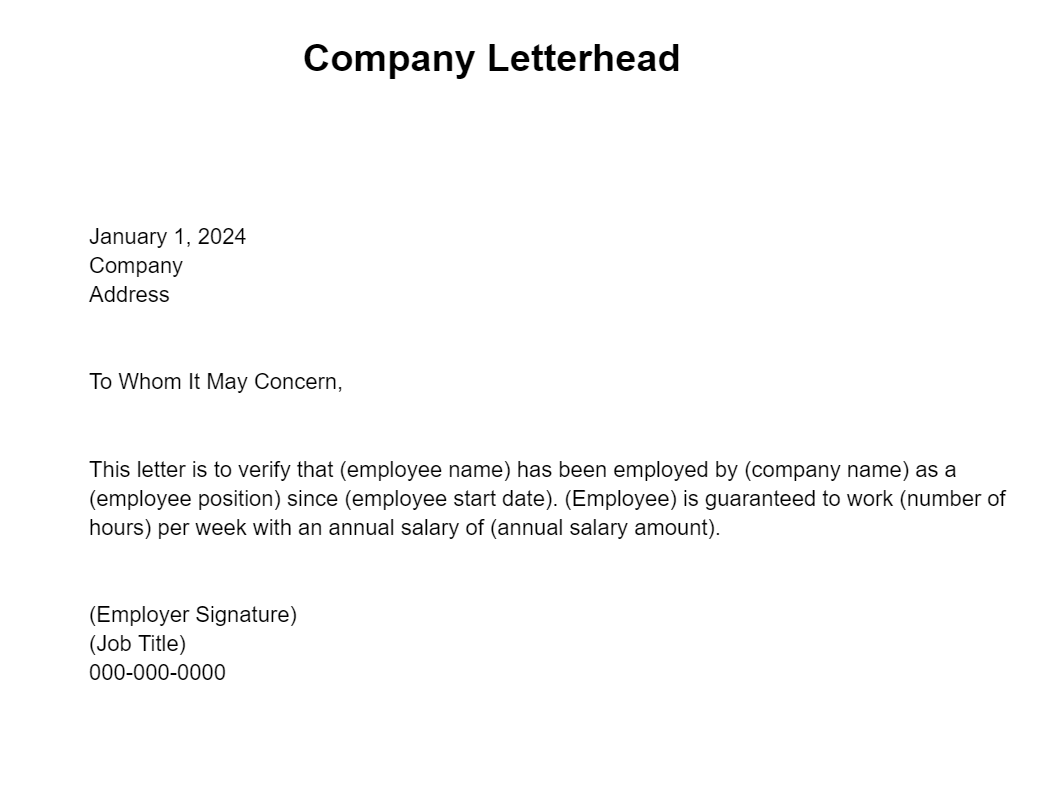

Employment Letter

A job letter is a current-dated document to confirm your job status with your employer. There is critical information required in that document and typically paired with your pay stubs and T4’s.